What is Credit Restoration?

Remove Negative Items From Your Credit Reports

WHAT IT IS … Quite simply, credit restoration, also referred to as credit repair, is the process of disputing the accuracy or verifiability of account information in your credit reports. Disputing information in your credit reports with the credit reporting agencies (CRAs), creditors and collection agencies is a legal right afforded to consumers through provisions of the Fair Credit Reporting Act (FCRA) and other federal consumer protection laws.

Upon receiving a dispute, CRAs and creditors have 30 days to investigate and ascertain whether the accounts are incorrect, outdated or unverifiable. If so, any such accounts must be removed from the credit report and the results of the investigation sent to the consumer within 5 days.

WHAT IT IS NOT… Credit restoration is not simply updating information on your credit report to reflect accurate account balances or status. Nor is it credit counseling or debt settlement - like you see advertised on TV so often.

QUALITY OF SERVICE MATTERS… As credit restoration increases in public awareness, and with more companies arising in the industry to provide these services, it’s important to understand the differences and quality of service among providers. After all, when it comes to any type of service being provided, it’s the methods and quality of work performed that a consumer is really purchasing.

For example; the level of competence of a car salesman doesn’t affect the quality or performance of the car you purchase. However, the level of competence and quality of workmanship of your mechanic matters greatly. The same holds true with credit restoration. The quality of service and methods used are crucial to the outcome.

Determining the steps needed to take and executing those steps requires cooperation between the credit restoration company and the customer. In addition to the dispute services provided, consultation and education of the customer is vital to maximizing credit score improvement. Often, the customer needs to take action on things which only they have control over. This would include such areas as managing revolving debt ratios, whether to pay off collections, and how to establish needed trade lines, to name a few.

You may already know that derogatory accounts that appear on your credit report will hurt your credit score. And the more negative accounts you have, the lower your score will be.

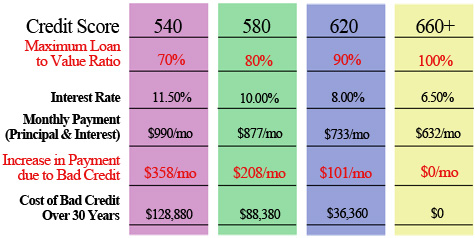

As you may imagine, a credit worthy consumer is rewarded with the best financing rates, insurance rates, employment opportunities, renting opportunities, and peace of mind. Below is an example of how much it can cost to have bad credit.

The above figures are based on a $100,000 mortgage loan for 30 years. Bear in mind that when looking at this diagram, it is not meant to give an exact description of interest rates and mortgage loan programs. However, this chart shows the relative difference a better credit score will have on mortgage financing.

It's Your Legal Right to Dispute Items

The Fair Credit Reporting Act (FCRA) - was enacted in 1970 and was the first federal law to regulate the use of personal information by private businesses - those businesses being the CRAs.

The Act's primary protection requires that CRAs follow "reasonable procedures" to protect the confidentiality, accuracy, and relevance of credit information. Generally it states that you have the right to question any information on your credit reports that you feel may be questionable, such as accounts that you may feel are: inaccurate, misleading, untimely, ambiguous, incomplete, unverifiable, biased or vague.

- Fair and Accurate Credit Transactions Act (FACTA) - was enacted in 2003 to amend the Fair Credit Reporting Act, to prevent identity theft, improve resolution of consumer disputes, improve the accuracy of consumer records, make improvements in the use of, and consumer access to credit information. You can view a summary fact sheet on FACTA provisions at the Privacy Rights Clearing House Organization website here.

- Fair Debt Collections Practices Act (FDCPA) - was enacted in 1977 to provide guidelines for collection agencies and attorneys which are seeking to collect legitimate debts, while providing protections and remedies for debtors.

Essentially, collection agencies fall under considerable scrutiny and legal requirements when it comes to the activity of debt collection. Employing your rights under this law is described comprehensively in the “What is Debt Validation” section of our Credit Library. Included in this section are the steps to follow that require CAs to validate a debt upon request, along with the steps and court case precedence to pursue legal action if necessary to force compliance.

- Fair Credit Billing Act (FCBA) - enacted in 1974 to protect consumers from billing errors on "open end" credit accounts, such as credit cards, and revolving charge accounts - such as department store accounts. It does not cover installment contracts - loans or extensions of credit you repay on a fixed schedule.

The law defines a wide gamut of credit account problems as "billing errors." These include a charge for something you didn't buy, a charge with the wrong date or amount and a charge for goods or services that you didn't receive or accept.

Once a mistake is identified you have 60 days to send a written dispute to the creditor notifying them of the mistake. They are required to acknowledge the dispute within 30 days and complete their investigation of the charge within 90 days. The law is really on the consumers’ side. With the proper steps many of these billing errors are resolved in favor of the consumer. The FTC provides more information.

You Can Do It Yourself

Like many things in life, credit restoration is something you can do yourself. It’s not rocket science. However, there is a RIGHT - WAY, and a WRONG - WAY to work at restoring your credit. For instance; many people think that if they send a letter along with copies of their collection receipts to the CRAs, that the item will be corrected to show a zero balance or even be removed from the report. If only it worked that way. The reality is that most of the time the CRA probably won’t do a darn thing because you didn’t invoke the law in your letter requiring them to do anything. Not only that, if they do update how the account is reporting, they aren’t going to remove it. In fact, good luck at trying to remove it later since you just provided them with the verification of the account and the information about it. Without realizing it, you just did the CRAs work for them and most likely eliminated the possibility of getting the item deleted from your credit report.

There are many key elements to effectively disputing information in a credit report and following up with the CRAs, creditors and collection agencies. It’s not hard, but there is a learning curve. You need to know how to read a credit report, have a good grasp of how to use the laws, develop a strategy of attack, and know effective follow up techniques.

In addition to learning the techniques and strategies, restoring your credit can be a tedious and time consuming endeavor. It’s imperative to keep track of your previous dispute activities, time frames and remembering where you are at in your overall strategy. This requires organization and keeping good notes.

Again, like anything in life, the more you do something, the better you get. Probably the biggest challenge people have in doing their own credit restoration is that they just don’t have the time to devote to learning what to do, and then doing it conscientiously and persistently, all the while keeping organized. Quite frankly, they usually feel that they have better things to do with their time.

DO NOTHING, EXPECT NOTHING... Errors are bound to appear in your credit report. In fact, according to a 2004 report made by the National Association of State PIRGs (Public Interest Research Group) 25% of credit reports contain errors that result in people being denied credit! If you don’t review your report once in a while, you won’t know what’s reported in it. And then, when you apply for credit or employment and find that you are denied because of your credit, well… what do you expect?

The bottom line is, you have the right to do something about it. Don’t expect the CRAs or creditors to make sure that your credit report is up-to-date and accurate. That’s your responsibility. If there’s errors, then you can and should dispute them.

Hire a Professional

Our mission is “Helping People Manage & Grow Their Credit Worthiness”.

We believe that each person’s credit situation is unique and requires a custom plan of action. In addition to this, we also believe that customer communication, consultation and education are crucial to accomplishing our customers’ goals.

We have developed our business almost exclusively through referrals from banks and loan officers and have helped literally thousands of people improve their credit.

When you hire a credit restoration company, there are disclosures and laws regulating their activities. View Credit Matters registration certificate as a registered credit service organization with the State of Wisconsin.

View a copy of the State and Federal Disclosure Statements for credit restoration customers.

View the Credit Repair Organizations Act (CROA); signed into federal law to protect the public from unfair or deceptive advertising and business practices by credit repair organizations.